Lucid's electric future shines bright with new SUV, doubled production, and a leadership shift

Lucid Motors is on a roll, and it has set some seriously ambitious goals for 2025. The company wants to double its electric vehicle production, driven mainly by the launch and ramp-up of its new electric SUV, the Gravity. This highly optimistic outlook comes with a significant change in leadership - CEO Peter Rawlinson is stepping down to become a Strategic Technical Advisor, and COO Mark Winterhoff takes over as interim CEO.

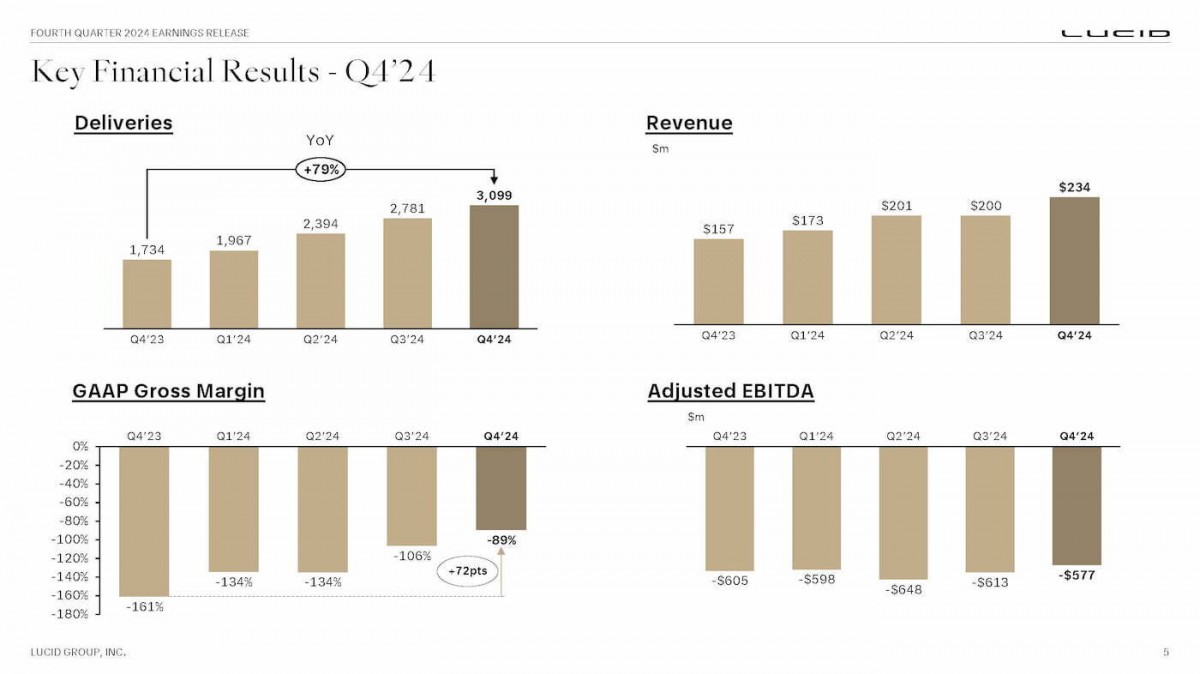

In its fourth-quarter earnings report, Lucid delivered positive results that surpassed Wall Street's expectations. The company reported Q4 revenue of $234.5 million - that's nearly a 50% increase from the last year. This performance contributed to a total revenue of $807.8 million for 2024, up from $595.2 million in 2023. Additionally, Lucid's earnings per share (EPS) loss was lower than anticipated, at -$0.22 compared to the expected -$0.25.

Lucid's production numbers also showed significant growth. In 2024, the company delivered 10,241 EVs, a 70% increase from the approximately 6,000 delivered in 2023. The fourth quarter alone saw 3,099 deliveries, nearly 80% more than the same period the previous year. This growth is attributed to increased efficiency at its manufacturing plant in Casa Grande, Arizona, where 9,029 EVs were produced in 2024.

Looking ahead, Lucid expects to produce around 20,000 vehicles in 2025. This means doubling the current production levels, mainly thanks to the introduction of the Gravity SUV, which launched in December. The company aims to "continue to prudently manage and adjust production to meet sales and delivery needs" throughout the year.

Lucid is also focusing on expanding its product line. The company plans to launch a midsize platform in the second half of 2026, which will include an electric SUV and sedan. These models are expected to start at around $50,000 and will compete directly with Tesla's Model 3 and Model Y.

Lucid has introduced significant discounts and incentives to attract more customers, offering up to $15,000 in savings on select Air models. Despite increased production and revenue, Lucid has also faced challenges, including a net loss of $992.5 million in the third quarter of 2024. However, the company has made progress in improving gross margins, which rose by 72 points to -89%.

With approximately $6.13 billion in liquidity, supported by the Public Investment Fund (PIF), Lucid believes it has sufficient funds to support its operations until the launch of its midsize platform. The change in leadership, with Peter Rawlinson moving to a strategic role and Mark Winterhoff stepping in as interim CEO, is a serious shift in focus as Lucid aims to scale its production and compete more effectively with other brands. Taoufiq Boussaid has also been appointed CFO.

Related

Reader comments

- Leon Musk

Hot damn. Does anybody have the phone number of the Saudi Public Investment Fund? I'd like to pitch them some very cool ideas that will lose 900M per quarter.

- 26 Feb 2025

- yJt