Tesla's growth engine sputters as earnings drop 23%

For years, Tesla seemed to operate on a different plane than other automakers. But its financial results for the second quarter of 2025 show the electric car giant is facing some very real-world gravity. The company's sales are down, profits are shrinking, and it's clear that its current lineup of electric cars is no longer enough to keep its incredible growth story going.

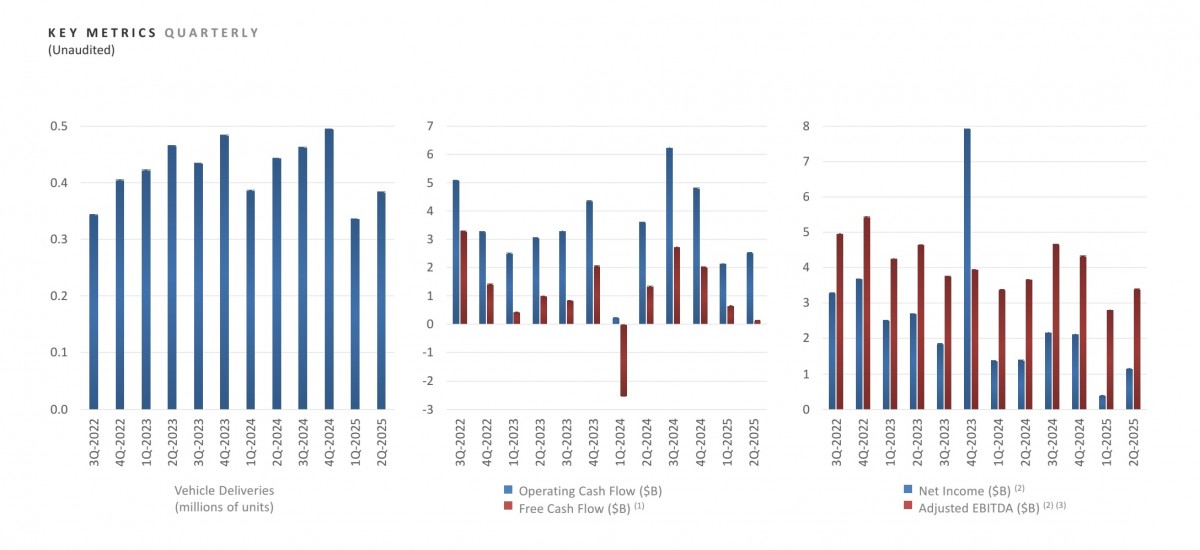

The numbers paint a stark picture of the challenges ahead. Tesla reported total revenues of $22.496 billion - that's a 12% drop compared to the last year. The decline in its automotive business was even bigger, with revenues falling 16%, down to $16.7 billion. The company delivered 384,000 vehicles globally, a big 13.5% drop from the second quarter of 2024.

This isn't just a blip; it follows a similar slump in the first quarter, suggesting a troubling trend for the world's most recognizable EV brand. The profit it makes from its main business, known as operating income, plummeted by 42%.

A major factor behind the slowdown is that Tesla is making less money on each car it sells. To keep its vehicles moving off lots, the company has relied heavily on discounts and incentives, such as offering free subscriptions to its Full Self-Driving (Supervised) software, complimentary Supercharging, and attractive financing deals. These tactics help sales numbers, but they cut directly into profits.

Compounding the issue is a sharp drop in income from regulatory credits. For years, Tesla earned billions by selling these environmental credits to other automakers who failed to meet emissions standards. In the last quarter, this income fell by nearly half to $439 million. With potential changes to federal emissions rules, this once-reliable stream of cash may soon dry up almost completely.

The company is also wrestling with a broader set of problems. In its report, Tesla pointed to an "uncertain macroeconomic environment," a polite way of saying that shifting tariffs and economic instability are making business difficult for everyone.

But some of Tesla's wounds are self-inflicted. Its vehicle lineup, once revolutionary, is starting to show its age. The Model 3 and Model Y, while still popular, are facing a flood of new, high-tech, and often cheaper competition, especially from Chinese EV makers. The much-hyped Cybertruck has not become the mass-market hit the company needed, leaving Tesla to rely on its older models to carry the brand.

Despite the gloomy figures, a flicker of hope was tucked away in the report. Tesla announced that it completed the "first builds" of a new, more affordable model in June. This has been the most anticipated vehicle in the company's pipeline, a project that has been talked about for years and seen numerous delays. The company stated it expects to begin mass production of this new EV in the second half of 2025.

The recent financial struggles reveal just how critical this new, cheaper electric car is to Tesla's future. The era of unchecked growth fueled by the Model 3 and Model Y appears to be over. The company's cash reserves even saw a slight dip for the first time in years, decreasing by about $200 million to $36.8 billion.

Related

Reader comments

Elon's return to private business did not help, Tesla has very serious problems. together with other carmakers. In a tensed market, the wrong decision cab kill your business.

- 24 Jul 2025

- n1@