Tesla's Q2 2024: a paradox of growth and decline in the EV market

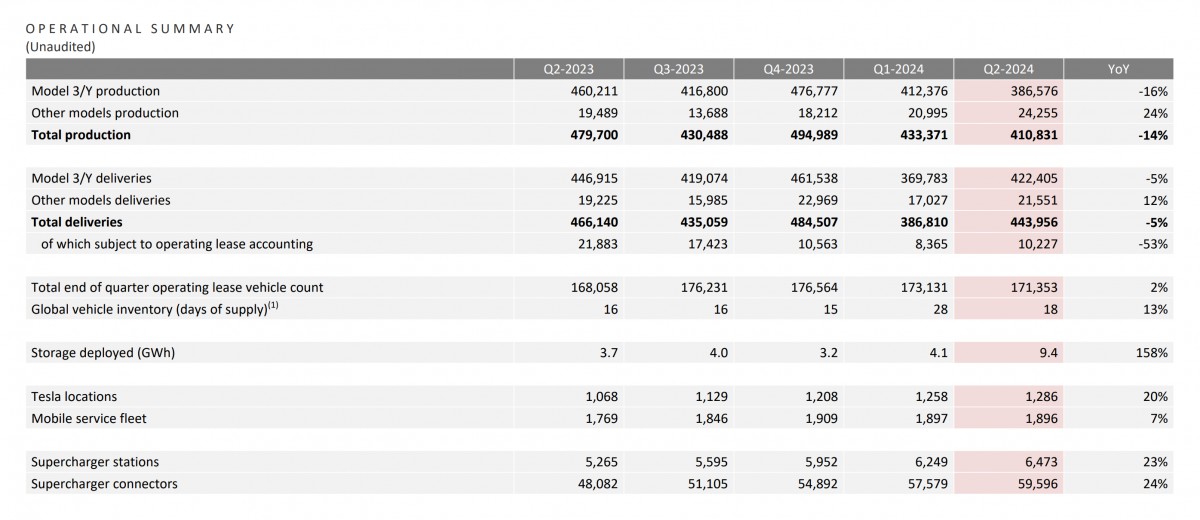

Tesla has unveiled its Q2 2024 earnings report, revealing a complex narrative of growth and setbacks in the ever-evolving EV landscape. While the company surpassed revenue expectations, reaching $25.5 billion with a 2% year-over-year increase, its automotive sales experienced a 7% dip, settling at $19.9 billion. This decline, coupled with earnings per share falling short of Wall Street's projections at 52 cents adjusted versus 62 cents expected, led to a substantial slide in after-hours trading. At the time of writing, TSLA shares were trading at $229.21 and falling.

Despite the decrease in automotive sales, Tesla cited "record regulatory credit revenues" as a contributing factor to its overall revenue growth. These credits, which are purchased by other automakers struggling to meet emission standards, tripled compared to the previous year, highlighting the ongoing challenges faced by the industry in transitioning to cleaner technologies.

Q2 2024 Shareholder Update → https://t.co/sXBSeLiJIj

— Tesla (@Tesla) July 23, 2024

— Highlights

We continued to expand our vehicle lineup globally, with new trims of Model 3 & Y as well as new S3XY paint options.

Vehicle

- Refreshed Model 3 ramp continued successfully

- We also continue to qualify more… pic.twitter.com/2UuLhlmjvD

Tesla's CEO, Elon Musk, used the earnings call to announce a rescheduled Robotaxi unveiling event for October 10th, further fueling anticipation for the company's autonomous driving ambitions. However, questions about the timeline for the first Robotaxi ride were met with cautious optimism, as Musk acknowledged the potential for delays while expressing confidence in achieving this goal within the next year.

The earnings report also shed light on Tesla's profitability challenges, with its adjusted earnings margin dropping from 18.7% in Q2 2023 to 14.4% in Q2 2024. This decline was attributed to various factors, including price reductions, restructuring charges, and investments in artificial intelligence infrastructure.

While Tesla maintains its position as the leading EV seller in the United States, it faces increasing competition from a growing number of rivals. This, coupled with the impact of Elon Musk's controversial statements and political affiliations, has contributed to a loss of market share. According to data tracked by Cox Automotive, Tesla's sales in the US declined by 9.6% during the first half of 2024, while rival automakers saw a 33% jump in fully electric vehicle sales.

Despite these challenges, Tesla remains optimistic about its future prospects. The company reported strong growth in its energy generation and storage business, with revenue nearly doubling from the same quarter a year ago. Additionally, production of the Cybertruck is ramping up, with the company projecting profitability for this model by the end of the year.

Related

Reader comments

Nothing yet. Be the first to comment.