Tesla Model 3 RWD and Long Range no longer qualify for Tax Credit

Tesla's Model 3 Rear-Wheel Drive (RWD) and Long Range versions are set to lose their eligibility for the $7,500 US electric vehicle tax credit at the start of 2024. This change is particularly significant for Tesla's most affordable EV model, and it appears to be linked to the source of its batteries.

Tesla updated its website to reflect this impending change. Previously, Tesla's website had advised potential buyers to take delivery of their new Model 3 before the end of the year to secure the full tax credit. However, this advice has now been revised, and as of 2024, buyers of the RWD and Long Range variants will no longer be eligible for any tax credit at all. Interestingly, the Performance trim seems unaffected by this change, at least for now.

Statement on Tesla's website

Statement on Tesla's website

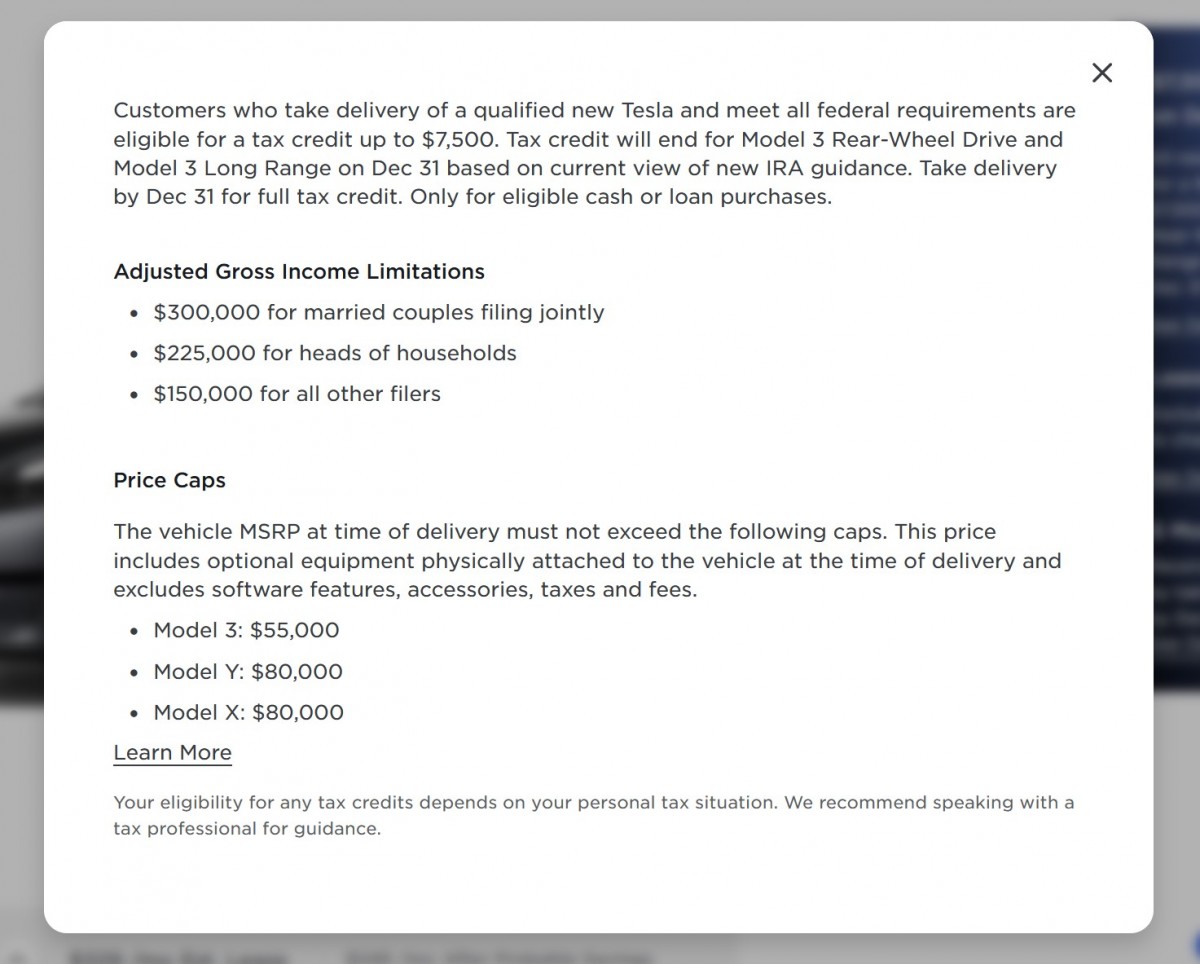

Tesla's website now states, "Customers who take delivery of a qualified new Tesla vehicle and meet all federal requirements are eligible for a tax credit up to $7,500. The tax credit will end for Model 3 Rear-Wheel Drive and Model 3 Long Range on December 31, 2023, based on the current view of new IRA guidance. Take delivery by December 31 to qualify for the full tax credit."

As of now, all Model 3 trims, the Model X Dual Motor, and the Model Y Long Range and Performance variants are eligible for the full $7,500 tax credit. However, there are price caps in place, with the Model 3 capped at $55,000 and both the Model X and Model Y at $80,000.

When it comes to the Model Y, Tesla has hinted at potential reductions in the tax credit after December 31. Still, there is no mention of such changes regarding the Model X.

The primary reason behind this significant shift appears to be the source of the batteries. The Model 3's batteries are sourced from China, a "foreign entity of concern" (FEOC) as per the updated tax rules. These rules explicitly state that any vehicle containing battery components from an FEOC will be disqualified from receiving tax breaks.

This development is far from ideal news for Tesla, which has continued its growth this year, largely fueled by the affordability of the Model 3 and Model Y. While Tesla may consider price adjustments to counteract the loss of tax credits, that will lead to significant profit margin reductions.

Related

Reader comments

Nothing yet. Be the first to comment.