Electric Last Mile Solutions goes bankrupt

Not a good day for founders of the Electric Last Mile Solutions. Both James Taylor and Jason Lou resigned from their posts, perhaps due to an ongoing SEC investigation into the company accounting processes. The company has announced it is filing for Chapter 7 bankruptcy.

There are many types of bankruptcies and the Chapter 7 is called the “straight” process - it cancels out all unsecured debts and secured debts are repaid with the liquidation of company assets. Debtors will be paid back according to the size of their investments - the bigger the investment the higher in the line for payout the debtor is. It means that small investors can be left out and not receive anything. It means as well that at the end of proceedings the company will cease to exist.

Maybe - just maybe - ELMS should have put more money into design?

Maybe - just maybe - ELMS should have put more money into design?

The shares of the company collapsed - at the time of writing they are at $0.19, a far cry from $11.56 they were trading at just this time last year. The company planned to import electric delivery vehicles from China and then assemble them in Indiana, at the former GM plant in Mishawaka.

The company went public in June last year with an IPO bringing it $379 million but the bad news started leaking out of the company pretty soon after. The founders were accused of making improper stock purchases just before a merger with SPAC was announced in December 2020. Soon after, the auditor of the company quit and the company failed to file its annual report. After that the company failed to file its latest quarterly report and as a result it became non-compliant with Nasdaq rules.

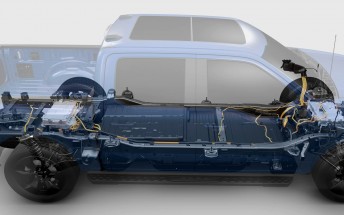

We won't be seeing this beauty on any road any time soon

We won't be seeing this beauty on any road any time soon

The bad news just kept on coming - the SEC started an investigation into the company's accounting and the ELMS cut its workforce by 24%. The market response was swift with the shares falling by 93%.

The EV revolution has claimed another victim and there will be more to come. By the time we have completely shifted away from fossil fuels we won’t even remember many companies, many big names will merge and many small names will be gone. Pick your investments wisely and don’t keep all of your eggs in one basket - best advice ever given to anyone wanting to try their luck on the market.

Related

Reader comments

Very good point. On another note - is it just me or does the photo above look like an angry Storm Trooper?

- 16 Jun 2022

- Stf

Well inflation is really bad. 100 years ago with 324 millions this would be one of most richest companies in world. Now they spend 324 millions in one year and are gone for good.

- 14 Jun 2022

- Lfw