Tesla announces Q3 results - new record with more than 343,000 vehicles delivered

The whole electric car world has been waiting for this moment, somehow Tesla’s performance is taken as a sign of how well or how bad the industry is doing. Tesla’s shares have been falling for the last couple of weeks but it was due to a wider market situation and possibly due to the Twitter saga more than due to Tesla’s actual performance.

The company did fall short of expectations when it came to the September deliveries but it still managed to deliver the biggest number of cars so far. So how did it do in the third quarter of 2022?

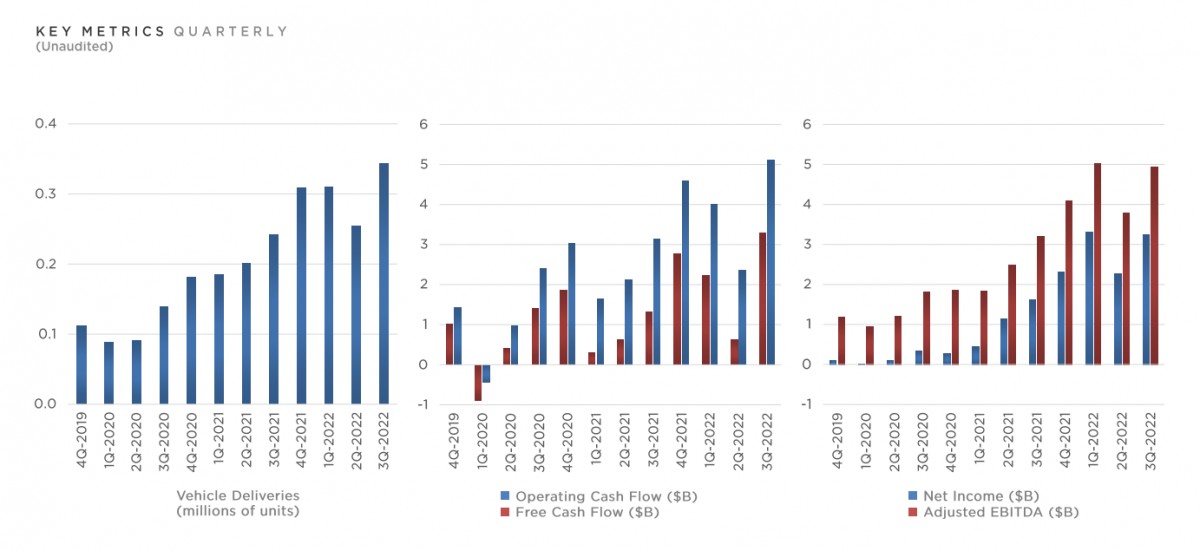

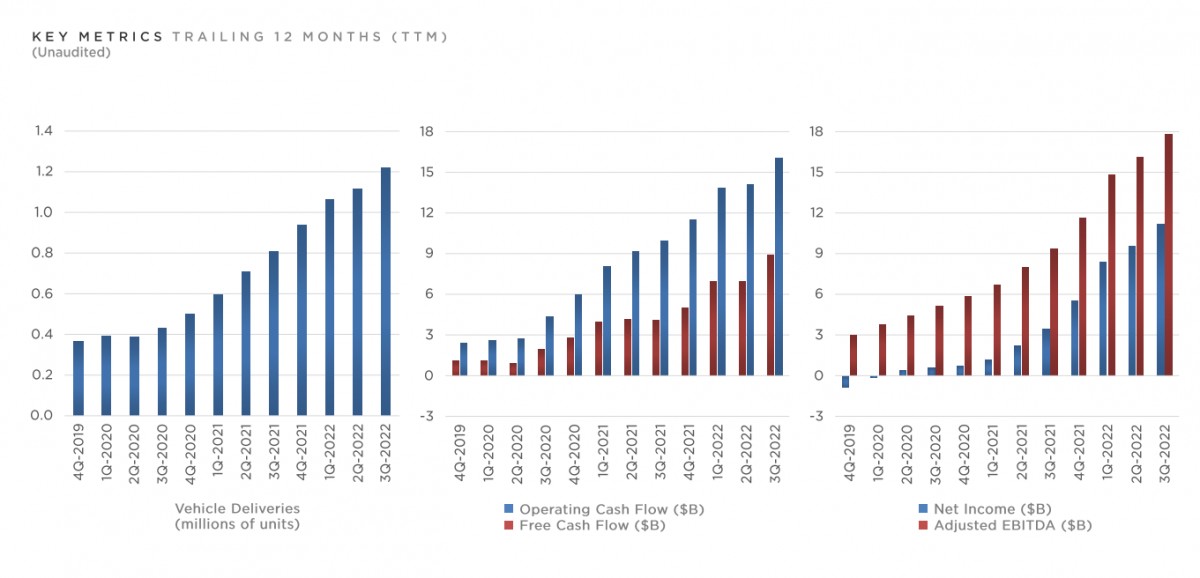

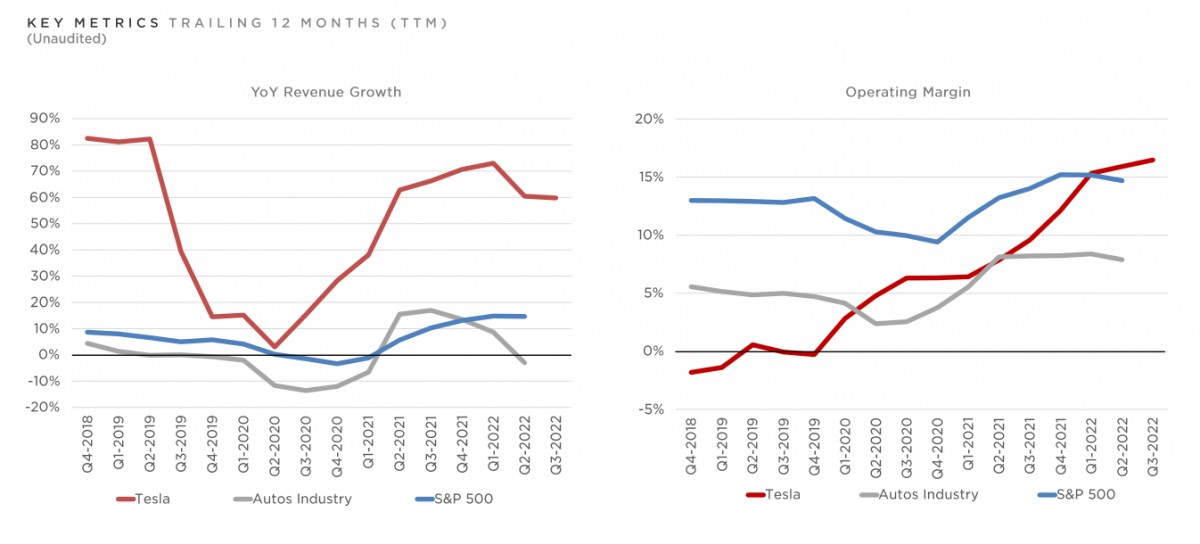

Tesla delivered $21.5 billion in revenue with an industry record 17.2 percent of profit margin making the company $3.7 billion in profit. That is a 56 percent growth in revenue year-on-year. The company manufactured 365,923 vehicles in total and it delivered 343,830 of them which again is a huge growth of 42 percent year-on-year. Tesla Model 3 and Model Y are responsible for the bulk of production and delivery with 345,988 of the cars manufactured and 325,158 delivered.

Tesla is sitting on a $21.1 billion pile of cash and marketable securities which has grown by $2.2 billion this quarter. The company deployed 94 MW of solar power and added 2,100 MWh of storage capacity in the Q3; it opened 4,283 Supercharger stations with 38,883 Supercharger connectors.

Tesla is focusing on ramping up the production at Giga Berlin which should achieve its 250,000 vehicle capacity some time next year, at the moment it just reached 2,000 vehicles a week which is about half of the expected capacity. Foremont is ramping up its production as well and the 4680 battery cell production tripled compared to the previous quarter.

The Cybertruck is coming - still - middle of next year, the tooling at the factory is going ahead according to plan according to the company. Tesla Semi is in early production stage with deliveries on schedule to begin in December. According to Elon Musk himself, a lot of progress has been made in the development of the Robotaxi.

Tesla’s predicted capacity for next year stands at 1.8 million vehicles - that’s without the Cybertruck and the Semi. If the company can ramp up its production at the rate it is currently doing it, next year is looking really good for Tesla’s shareholders.

Tesla is planning to increase its production at a 50 percent yearly rate and it has sufficient cash reserves to fund its operations. It plans to add revenue from software for the first time in addition to its car sales. Tesla’s FSD beta is being used by 160,000 drivers across the US and the company is planning to release the software to the public this year.

Third quarter was very busy for Tesla and although its revenue was slightly lower than predicted, its profit margins grew substantially. The production is up and growing, the deliveries are up and reaching record levels, the company is on target with most of its plans - will it be enough to appease the markets? We will find out as soon as the trading opens in the morning but after hours Tesla’s shares are already trading around 6 percent down at the time of publishing- it seems the investors were not impressed.

Related

Reader comments

In terms of technology that's like 100% true, in terms of support or value ... that's questionable. It certainly retains more value than let's say EV made by Mercedes or VW.

- 20 Oct 2022

- ps1

- Anonymous

Rather amazing! Tesla is still well ahead of the competition, in terms of value, technology, and support.

- 20 Oct 2022

- MKJ