The solid state battery race and the future of electric vehicles

There is no other way to put it - the automotive industry is on the verge of a seismic shift. Imagine a world where electric vehicles compete head-to-head with their fuel-powered counterparts in terms of range. That future might not be as far as we think, thanks to the latest developments in battery technology.

According to a report by TrendForce, we could be looking at EVs with all-solid-state batteries in mass production by the year 2030. This new generation of battery packs could potentially provide two to three times the range of today's liquid lithium batteries, catapulting EVs into the same league as conventional fuel vehicles.

At present, electric and plug-in hybrid vehicles primarily rely on liquid lithium batteries, mainly nickel-cobalt-manganese (NCM) and lithium iron phosphate (LFP). Yet these technologies seem to be already hitting their limits. The ranges these batteries currently offer - 311 miles to 373 miles for NCM, and 186 miles to 311 miles for LFP - still fall short of the 373 miles to 746 miles achievable by fuel-efficient vehicles.

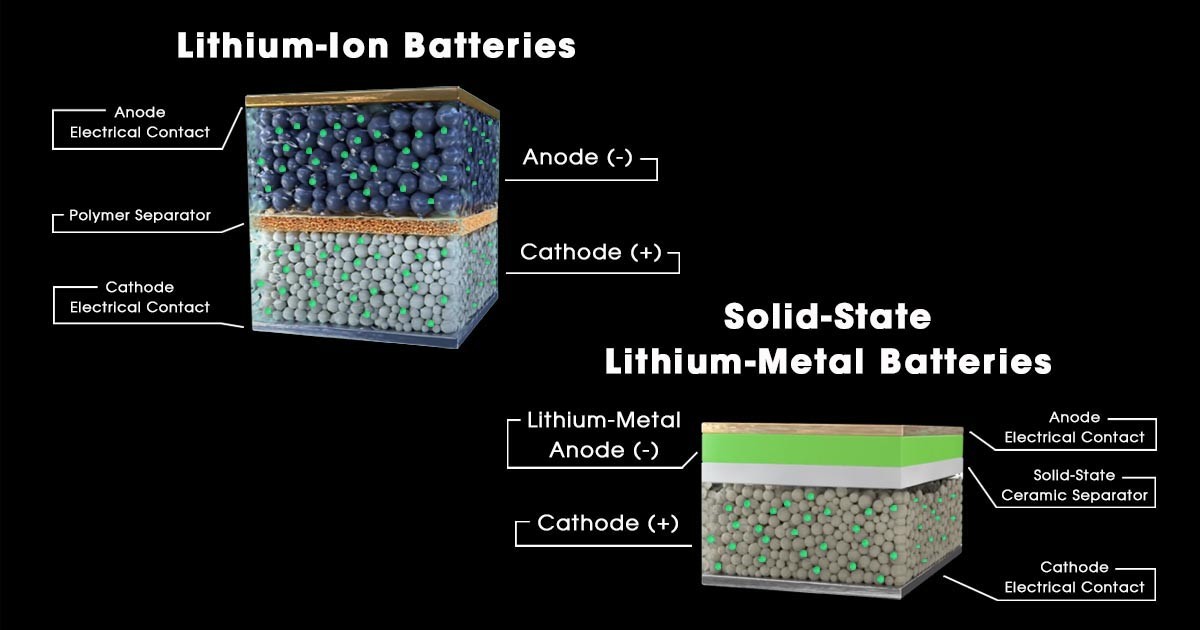

Solid-state batteries, however, can be a real game changer. The key difference? The electrolyte. Swapping out the traditional liquid version for a solid one brings a heap of advantages - more stability, a lower risk of thermal runaway during charging and discharging, and above all, increased energy density.

And the potential ways to this solid-state utopia? Sulfide, oxide, and polymer routes are all being explored, with sulfide and oxide currently touted as the best options for electric cars due to their energy density, efficiency, and safety credentials.

The global automotive industry is fiercely competing to be the first across the solid-state finish line. Japanese car manufacturers are taking the sulfide route, with Toyota, in collaboration with Panasonic, spearheading the charge toward mass production by 2027. Meanwhile, European and American car manufacturers have cast their nets wide, investigating all three technology routes.

In contrast, Chinese automakers are focusing on the oxide path and are already rolling out semi-solid batteries. While not quite reaching the energy density of the all-solid-state batteries, these semi-solid alternatives still provide an impressive 300-400 Wh/kg.

Companies like Nio, Dongfeng Motor, and Seres are quickly adopting this technology, with Nio recently unveiling a semi-solid-state battery that claims to offer a whopping range of over 620 miles.

It’s not a good time to break out the champagne just yet, though. The road to mass production of solid-state batteries is still full of obstacles. Technical hurdles and cost issues are just one side of the story, and the timeline for widespread vehicle implementation is uncertain. For instance, despite the promise of its semi-solid-state battery, Nio has seen its delivery schedule delayed multiple times. And while the battery's energy density is impressive, it comes with a slight weight penalty and a huge cost increase.

Still, the advent of solid-state batteries represents a major leap forward for the electric vehicle industry. The vision of an electric vehicle that can compete with traditional fuel-powered cars when it comes to driving range isn't just a pipe dream. It's a future that's already gently tapping on our doors. As this race intensifies, the knocking gets louder, and one thing is clear: the winners will not only shape the automotive industry but also our relationship with transportation.

Related

Reader comments

Nothing yet. Be the first to comment.