Tesla China's output slows down - shares tank

Reports of slowed production at Tesla's massive Shanghai facility emerged today. While some experts call this a sign of cooling demand within China's EV market, it could be a calculated move by the EV giant.

Reports claim that Tesla workers at the Shanghai plant now have a five-day work week, reduced from the previous six and a half. Certain production lines, including battery workshops, face even lengthier suspensions, according to insider sources. Tesla has reportedly hinted at continued slowed output at least through April, which aligns with the Tomb Sweeping Day holiday, a typically slow period for Chinese consumer spending.

Tesla Giga Shanghai

Tesla Giga Shanghai

This news comes amidst broader industry shifts within China's booming electric vehicle market. While the country's NEV (New Energy Vehicle) sector still grows handsomely, it's less explosive than in previous years. Additionally, Tesla now faces an ever-growing array of capable local rivals, particularly in the premium segment. Companies like BYD, Nio, and XPeng are aggressively targeting a similar customer base.

The Shanghai factory is a critical production and export hub for Tesla, boasting an annual output capacity of over 950,000 vehicles. Tesla fans will recall the company's strategic price adjustments in China in January 2024, a bold move that intensified price wars in the market. Interestingly, there are unconfirmed reports of a potential Tesla price hike in China this April. If true, this could be a clever way to urge hesitant buyers to quickly place orders while existing promotional offers are still available.

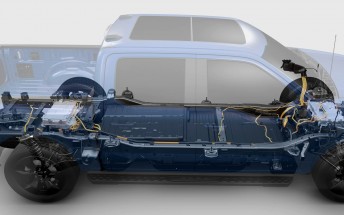

production line at Giga Shanghai

production line at Giga Shanghai

The question on everyone's mind is whether Tesla's adjusted production output is a defensive response to rivals or a proactive means to manage inventory and boost demand ahead of further pricing changes. It could also be a combination of factors, including supply chain adjustments and preparation for potential model upgrades.

Market analysts are keeping a close eye on Tesla's production adjustments. The EV sector, in general, seems to be reacting cautiously to these reports. This slowdown, combined with whispers of a potential price increase, could add to existing concerns that Tesla may be facing heightened competition within China. TSLA share price has seen some volatility following the initial report and at the time of writing is hovering around $166 in the before-hours trading session, suggesting investor uncertainty about the implications of Tesla's China strategy.

Related

Reader comments

Nothing yet. Be the first to comment.